As small businesses navigate the financial landscape, having access to the right resources and guidance is crucial for sustainable growth. In 2025, the role of local financial advisors has become increasingly vital for small businesses looking to optimize their financial strategies. This article will explore the best local financial advisors for small businesses, alongside essential strategies that can help enhance financial performance and drive growth.

Understanding the Role of Financial Advisors

Financial advisors serve as trusted partners, offering insights and strategies tailored to the unique needs of small businesses. They help business owners make informed decisions regarding cash flow management, investment opportunities, and financial planning. The right advisor can guide small businesses through challenges, ensuring they remain competitive in a rapidly changing market.

Key Strategies for Small Business Finance

In 2025, small businesses must adopt effective financial strategies to thrive. Here are some essential tactics recommended by leading local financial advisors:

1. Comprehensive Financial Planning

A well-structured financial plan is the backbone of any successful small business. Local financial advisors emphasize the importance of creating a comprehensive plan that includes budgeting, forecasting, and cash flow analysis. By understanding their financial position, small business owners can make proactive decisions that lead to growth.

2. Leveraging Technology

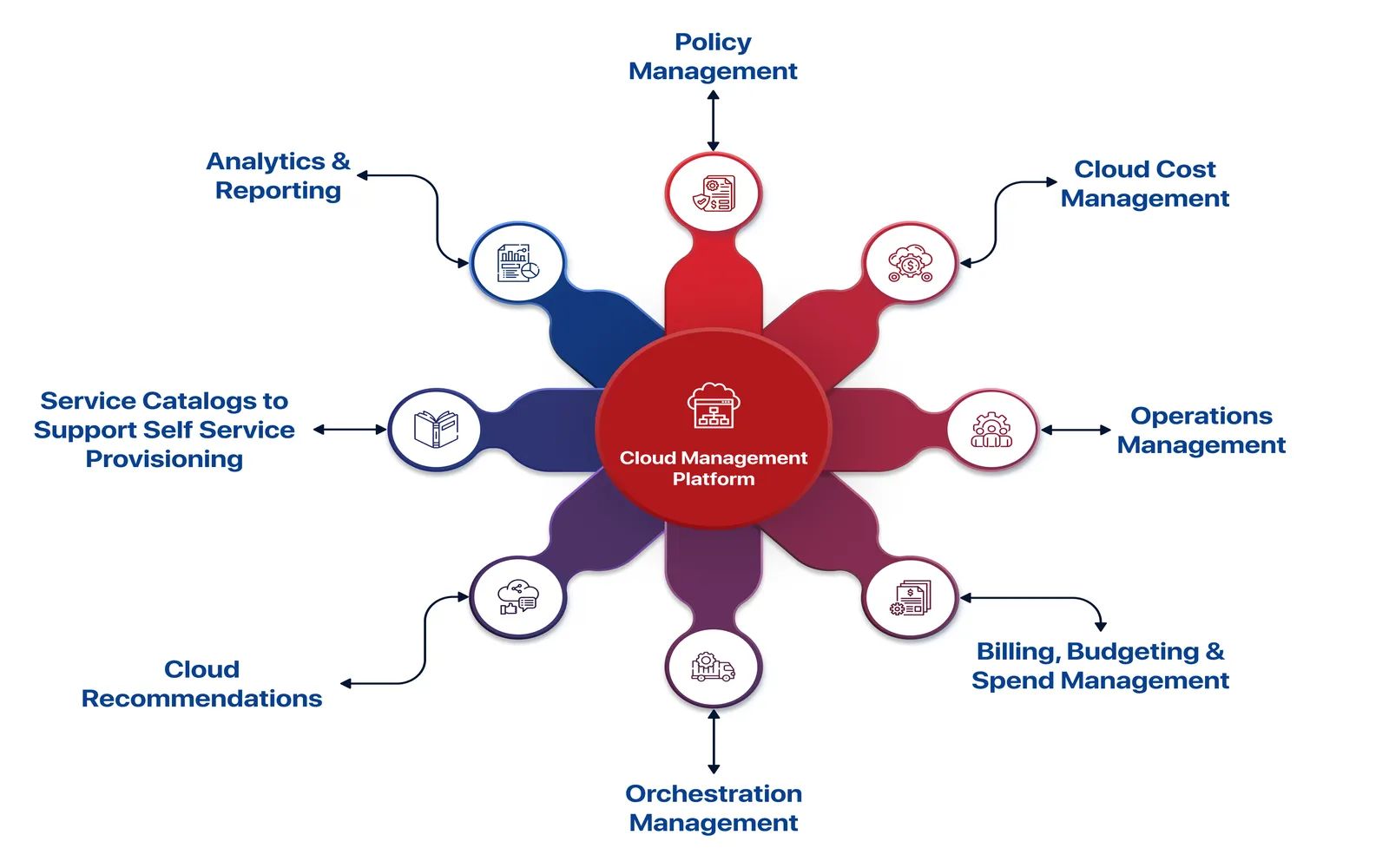

In the digital age, utilizing financial technology (fintech) solutions is crucial. Advisors recommend adopting accounting software, budgeting tools, and financial management platforms to streamline operations. These technologies not only save time but also enhance accuracy in financial reporting.

3. Building Strong Cash Reserves

Cash flow is the lifeblood of any small business. Financial advisors recommend maintaining strong cash reserves to manage unforeseen expenses and capitalize on growth opportunities. Small businesses should aim to have at least three to six months' worth of operating expenses in reserve.

4. Diversifying Revenue Streams

Relying on a single revenue stream can be risky. Local financial advisors suggest small businesses explore diversification by introducing new products, services, or markets. This strategy mitigates risk and can lead to increased sales and profitability.

5. Regular Financial Review

Continuous monitoring of financial performance is essential. Local financial advisors advocate for regular financial reviews to assess progress against goals and adjust strategies as needed. This proactive approach allows small businesses to stay agile in a dynamic market.

Top Local Financial Advisors for Small Businesses in 2025

Finding the right financial advisor can be transformative for small businesses. Here are some of the best local financial advisors making a significant impact in 2025:

| Advisor Name | Location | Specialization |

|---|---|---|

| Finance Solutions Group | New York, NY | Cash Flow Management |

| Small Business Financial Experts | Los Angeles, CA | Investment Strategies |

| Local Tax Advisors | Chicago, IL | Tax Planning |

| Growth Financial Partners | Houston, TX | Revenue Diversification |

| Greenway Financial | Miami, FL | Comprehensive Financial Planning |

The Importance of Personalization

Every small business is unique, with its own set of challenges and opportunities. This is where the value of personalized financial advice comes into play. Local financial advisors understand the intricacies of the local market and can tailor their strategies to meet specific business needs. This personalized approach not only enhances the effectiveness of financial strategies but also fosters a trusting relationship between the advisor and the business owner.

Staying Informed and Adaptable

In 2025, economic conditions and market dynamics are continuously evolving. Small businesses must remain informed about industry trends and adapt their strategies accordingly. Local financial advisors play a pivotal role in providing insights that help businesses stay ahead of the curve. By keeping abreast of changes in small business finance, entrepreneurs can make timely decisions that promote growth and sustainability.

Conclusion

Partnering with a reputable local financial advisor is essential for small businesses aiming for financial success in 2025. By implementing key strategies and leveraging expert advice, business owners can navigate the complexities of small business finance with confidence. Whether it's through comprehensive financial planning, technology adoption, or revenue diversification, the right guidance can make all the difference in achieving long-term growth and prosperity.