When it comes to protecting your home, homeowners insurance is an essential investment. It safeguards not only your property but also your peace of mind. In this ultimate guide, we will explore how to secure the best homeowners insurance in your area, ensuring that you have the right coverage tailored to your needs.

Understanding Homeowners Insurance

Homeowners insurance is a policy that provides financial protection against damage to your home and its contents. It typically covers risks such as fire, theft, vandalism, and certain natural disasters. Additionally, it includes liability coverage that protects you in case someone is injured on your property.

Key Components of Homeowners Insurance

Before you start shopping for homeowners insurance, it’s vital to understand the key components of a typical policy:

- Dwelling Coverage: Protects the structure of your home against covered perils.

- Personal Property Coverage: Covers personal belongings, including furniture, electronics, and clothing.

- Liability Protection: Offers coverage in case someone is injured on your property or if you cause damage to someone else's property.

- Additional Living Expenses (ALE): Covers living costs if your home becomes uninhabitable due to a covered event.

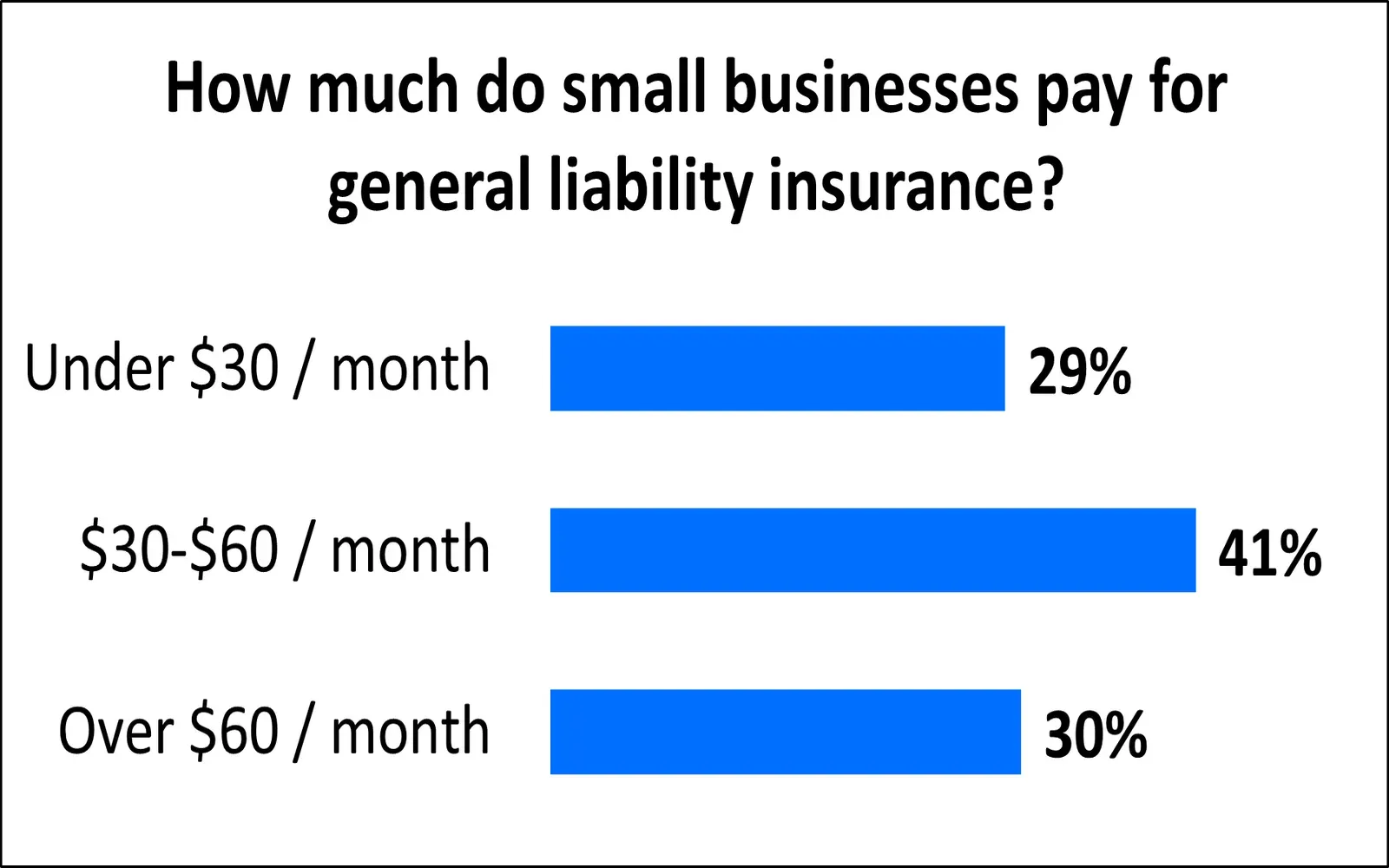

Factors Influencing Homeowners Insurance Rates

Several factors can impact the cost of your homeowners insurance premium. Understanding these can help you find the best rates:

- Location: Homes in areas prone to natural disasters may face higher premiums.

- Home Value: The more valuable your home, the higher your coverage amount—and premium.

- Deductibles: A higher deductible can lower your premium, but it will increase your out-of-pocket expense during a claim.

- Credit Score: Insurers often use credit scores to assess risk; a lower score could lead to higher premiums.

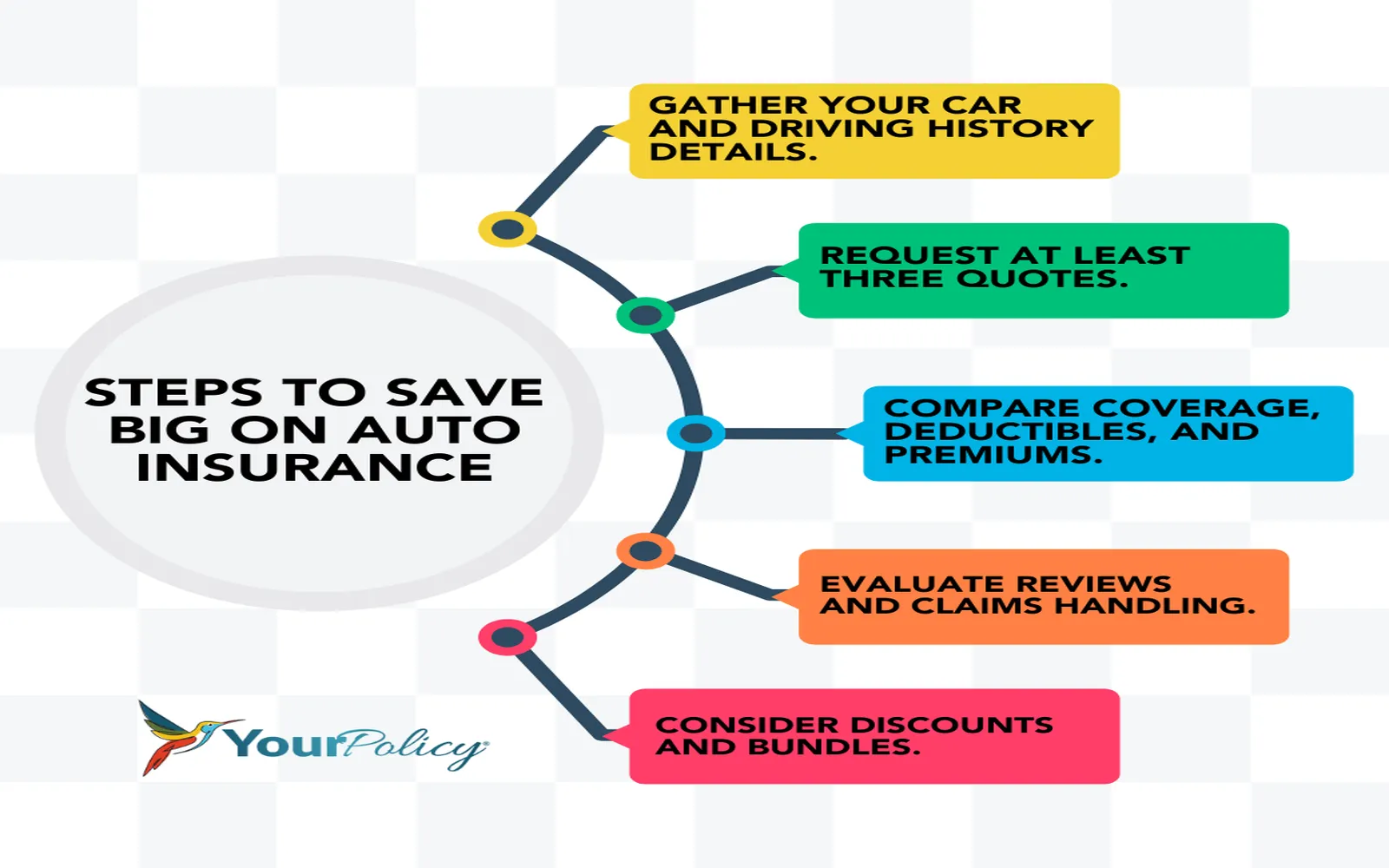

Steps to Secure Top Homeowners Insurance

To ensure you are getting the best homeowners insurance, follow these steps:

1. Assess Your Coverage Needs

Determine how much coverage you need by evaluating the value of your home and personal belongings. Make a detailed inventory of your possessions to understand what you need to protect.

2. Shop Around for Quotes

Contact multiple insurance providers to obtain quotes. Be sure to compare not just the prices but also the coverage options and deductibles. Use an online comparison tool to make this process easier.

3. Check for Discounts

Many insurers offer discounts that can lower your premium. Some common discounts include:

- Bundling policies (e.g., auto and home insurance)

- Installing security systems

- Staying claims-free for a certain number of years

4. Read Reviews and Ratings

Research the insurance companies you are considering. Look at customer reviews and ratings to gauge their reputation for customer service and claims handling. Websites like J.D. Power and Consumer Reports can provide valuable insights.

5. Understand Policy Terms

Before signing any policy, carefully read the terms and conditions. Pay attention to coverage limits, exclusions, and the claims process to avoid surprises later on.

Chart: Homeowners Insurance Coverage Comparison

| Insurance Provider | Dwelling Coverage | Personal Property Coverage | Liability Coverage | Average Premium |

|---|---|---|---|---|

| Provider A | $300,000 | $150,000 | $300,000 | $1,200 |

| Provider B | $350,000 | $200,000 | $500,000 | $1,500 |

| Provider C | $400,000 | $250,000 | $300,000 | $1,000 |

Final Thoughts

Securing the right homeowners insurance is crucial for protecting your most significant investment—your home. By understanding your coverage needs, shopping around for the best rates, and comparing policies, you can find a plan that offers the coverage you need at a price you can afford. Remember, the goal is not just to save money but to ensure that you have adequate protection that brings you peace of mind.

In conclusion, take the time to evaluate your options carefully, and don’t hesitate to reach out to agents for clarification on any terms or conditions that you don’t understand. Your home is worth protecting, and so is your peace of mind.