As we step into 2025, many homeowners and vehicle owners are looking for ways to save on their insurance costs. Bundling your home and auto insurance can be a smart financial decision, offering significant discounts and streamlined management of your policies. In this article, we will explore the top home and auto insurance package deals available in 2025, helping you maximize your savings.

Understanding the Benefits of Bundling Home and Auto Insurance

Bundling home insurance and auto insurance is one of the most effective ways to lower your premiums. Insurers often provide attractive discounts for customers who choose to combine their policies. Here are some benefits of bundling:

- Cost Savings: You can save up to 25% on your overall insurance costs by bundling.

- Simplified Payments: Managing one policy instead of two makes it easier to keep track of payments and renewals.

- Better Coverage Options: Bundling can lead to access to enhanced coverage options that may not be available if you purchase policies separately.

Top Home and Auto Insurance Package Deals for 2025

Here’s a look at some of the leading home and auto insurance package deals for 2025, along with their key features and discounts:

| Insurance Provider | Discount Percentage | Key Features | Customer Rating |

|---|---|---|---|

| State Farm | 25% | Customizable coverage, 24/7 customer service | 4.5/5 |

| Geico | 20% | Easy online management, extensive discounts | 4.7/5 |

| Allstate | 30% | Personalized coverage options, accident forgiveness | 4.6/5 |

| Progressive | 20% | Unique Name Your Price tool, bundling options | 4.4/5 |

| Liberty Mutual | 15% | Flexible payment plans, extensive coverage choices | 4.3/5 |

When choosing a home and auto insurance bundle, it's crucial to evaluate each provider based on not only the discounts offered but also the customer service, coverage options, and overall reputation. Each of the above providers has a strong presence in the market and offers solid package deals, making them worthy contenders for your insurance needs in 2025.

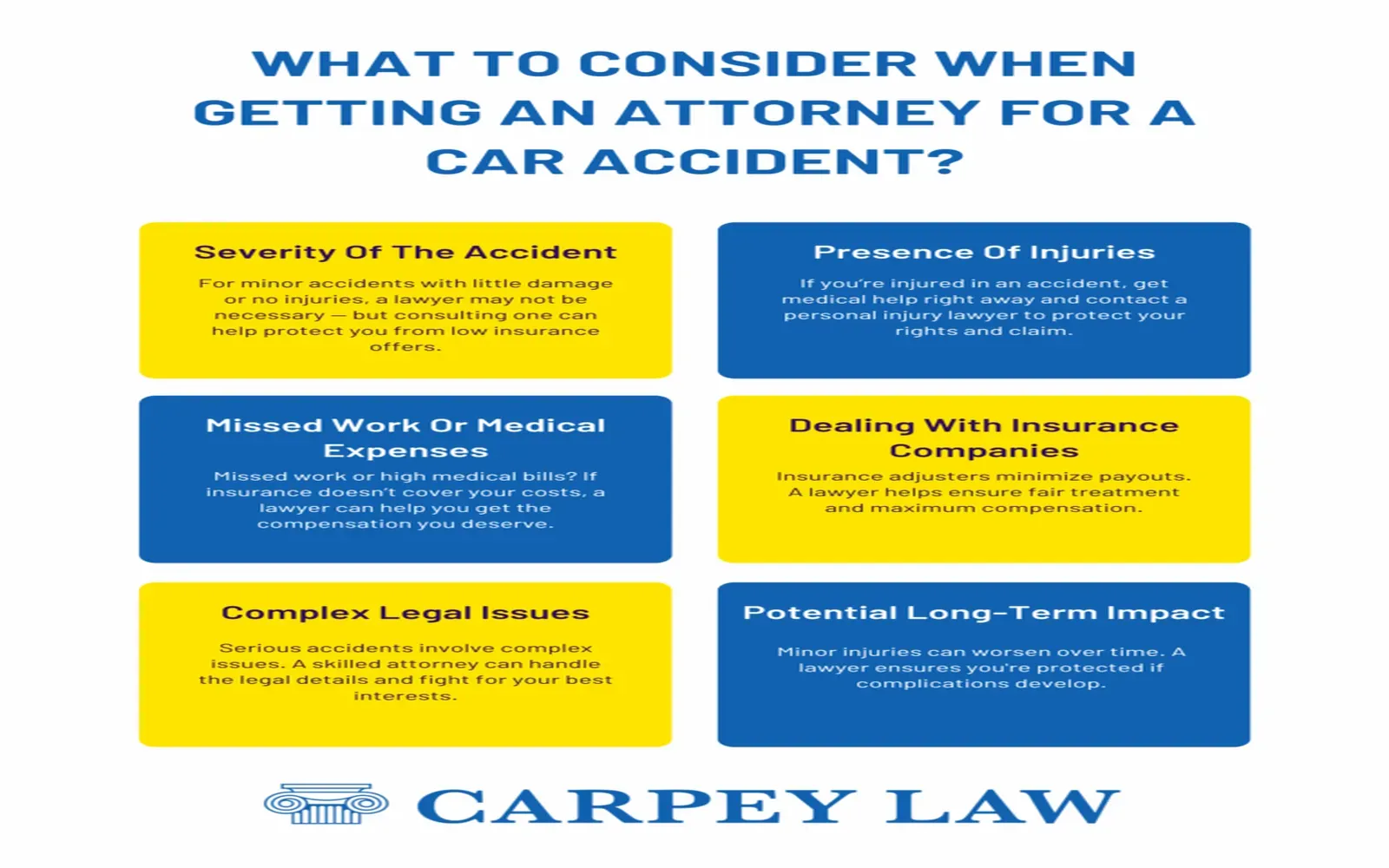

Factors to Consider When Choosing a Bundle

While savings are essential, there are other factors to consider when selecting a home and auto insurance package deal:

- Coverage Limits: Ensure that the combined policy provides adequate coverage for both your home and vehicle.

- Deductibles: Compare deductibles across different providers to find a balance between premium costs and out-of-pocket expenses.

- Policy Add-ons: Look for optional coverages, such as rental car reimbursement or identity theft protection, that may be beneficial.

- Claims Process: Research the claims process for each provider. A smooth claims experience can significantly impact your satisfaction.

How to Maximize Savings on Your Insurance Package

To further enhance your savings when bundling home and auto insurance, consider the following tips:

- Improve Your Credit Score: Many insurers use credit scores to determine premiums. A higher score can lead to lower rates.

- Increase Your Deductibles: Opting for a higher deductible can lower your premium, but ensure you can afford the out-of-pocket costs in the event of a claim.

- Take Advantage of Discounts: Inquire about available discounts, such as safe driver discounts, multi-policy discounts, and home security discounts.

- Review Your Coverage Regularly: Regularly reassessing your insurance needs can help you avoid overpaying for unnecessary coverage.

Conclusion

As we look ahead to 2025, bundling your home and auto insurance is a strategic way to save money while ensuring you have comprehensive coverage. By comparing package deals from reputable providers and considering various factors, you can maximize your savings and find the best insurance solution for your needs. Remember to evaluate your options regularly and make adjustments as necessary to keep your insurance costs manageable.