When it comes to choosing between rewards cards and cashback cards, understanding the differences and advantages of each can help consumers make informed financial decisions. Both types of cards offer unique benefits, but the ultimate value depends on individual spending habits and preferences. Below, we will explore the key features of rewards cards and cashback cards, and provide a comparison to help you determine which option may offer greater value for your lifestyle.

Understanding Rewards Cards

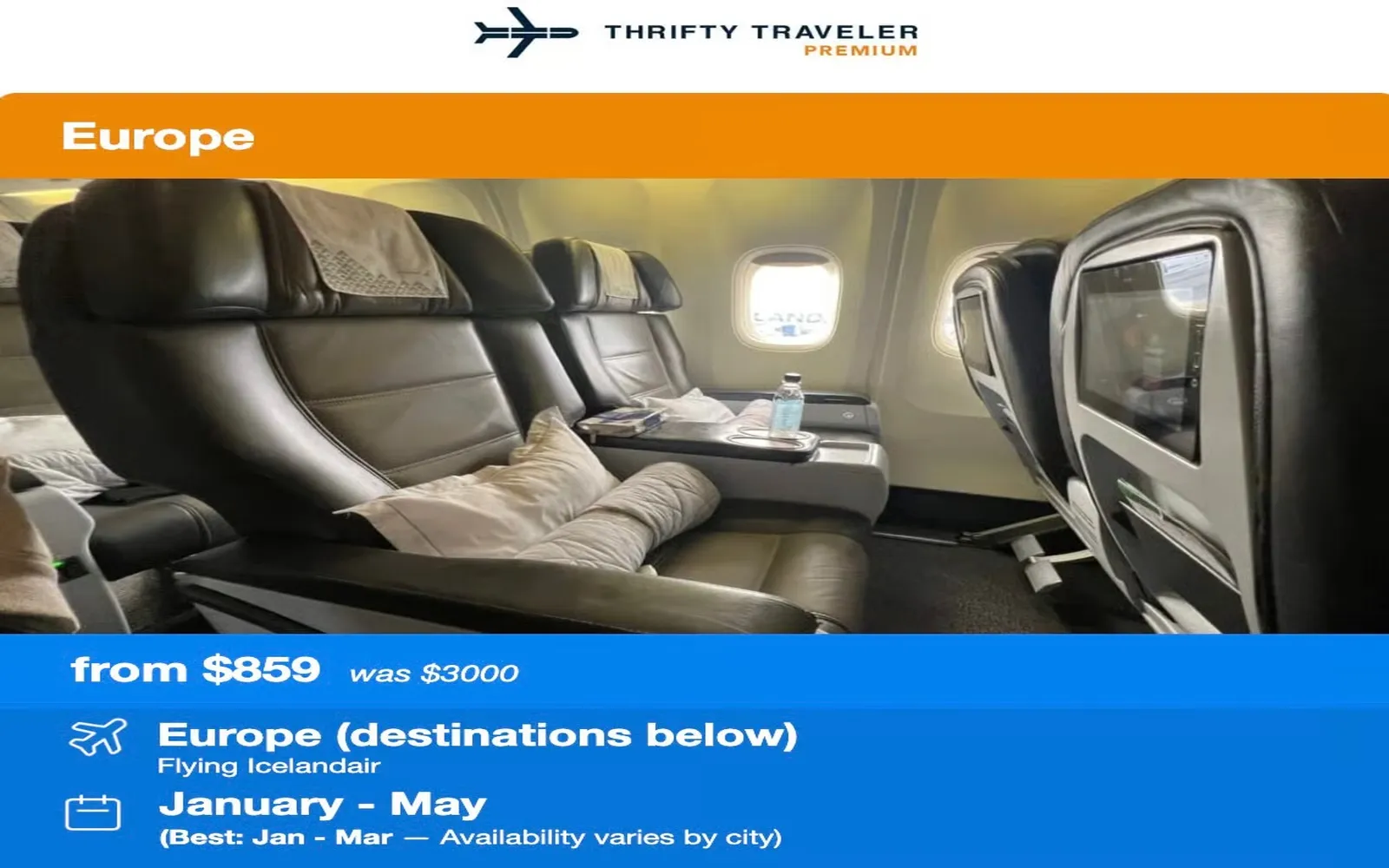

Rewards cards typically allow users to earn points or miles for every dollar spent. These points can be redeemed for a variety of rewards, such as travel, merchandise, or gift cards. Many rewards cards are affiliated with specific airlines or hotel chains, providing additional perks for frequent travelers. For example, a rewards card may offer bonus points for purchases made with certain travel partners, enhancing the overall value for users who travel often.

One of the main benefits of rewards cards is the potential for high-value redemptions. If you are strategic about how you use your points, you can often get more value per point when redeeming for travel compared to cash. However, it is essential to note that the value of points can fluctuate based on availability, blackout dates, and other factors.

Exploring Cashback Cards

Cashback cards, on the other hand, provide a straightforward approach to earning rewards. Users earn a percentage of their spending back in cash, typically ranging from 1% to 5%, depending on the card and the category of purchases. This makes cashback cards appealing to those who prefer simplicity and transparency in their rewards program.

One significant advantage of cashback credit cards is that the rewards are immediate and can be applied to the card balance or redeemed as a statement credit. This can be more beneficial for consumers who want to see tangible benefits without the complexities of point systems. Additionally, cashback rewards are usually more flexible, allowing users to utilize their earnings however they choose.

Comparative Analysis of Value

To help illustrate the differences in value between rewards cards and cashback cards, we have created a comparison chart below:

| Feature | Rewards Cards | Cashback Cards |

|---|---|---|

| Rewards Structure | Earn points or miles | Earn cash back |

| Redemption Options | Travel, merchandise, gift cards | Cash, statement credits |

| Potential Value | Can be higher with strategic redemptions | Fixed value (1% - 5% back) |

| Bonus Categories | Often offers bonus points for specific categories | May offer higher percentages for certain categories |

| Annual Fees | May have higher fees | Often no annual fee |

| Flexibility | Less flexible due to point expiration and restrictions | Highly flexible; cash can be used for any purpose |

Which Card Offers Greater Value?

The choice between cash back credit cards and rewards cards ultimately depends on your spending habits and personal preferences. If you frequently travel and can maximize the value of your points through strategic redemptions, a rewards card may provide greater value. For those who prefer simplicity and want to earn immediate rewards without the hassle of managing points, a cashback card is likely the better option.

Another factor to consider is how you typically spend. Cashback cards are particularly advantageous for everyday purchases, as they offer consistent rewards on all spending. In contrast, rewards cards may excel in specific categories, like travel or dining, so if these areas represent a significant portion of your spending, you might benefit more from a rewards card.

Conclusion

In summary, both rewards cards and cashback cards have their unique benefits and potential drawbacks. When deciding which type of card offers greater value, consider your financial goals, spending patterns, and lifestyle. By carefully evaluating your options, you can select a card that aligns with your needs and maximizes your rewards potential. Whether you choose a rewards card or a cashback card, being informed will help you make the most of your credit card experience.