In today's rapidly changing business landscape, effective budgeting is crucial for the success and growth of any organization. Leveraging the right financial software can significantly enhance your budgeting process, providing you with the tools necessary to make informed decisions. This article explores the best accounting solutions available and how they can help you optimize your business budgeting.

The Importance of Business Budgeting

Budgeting is not just about keeping track of income and expenses; it’s a strategic function that allows businesses to plan for the future. A well-structured budget helps organizations allocate resources efficiently, minimize waste, and maximize profits. Financial software plays a pivotal role in this process by automating calculations, providing real-time insights, and facilitating collaboration among team members.

Key Features of Effective Accounting Solutions

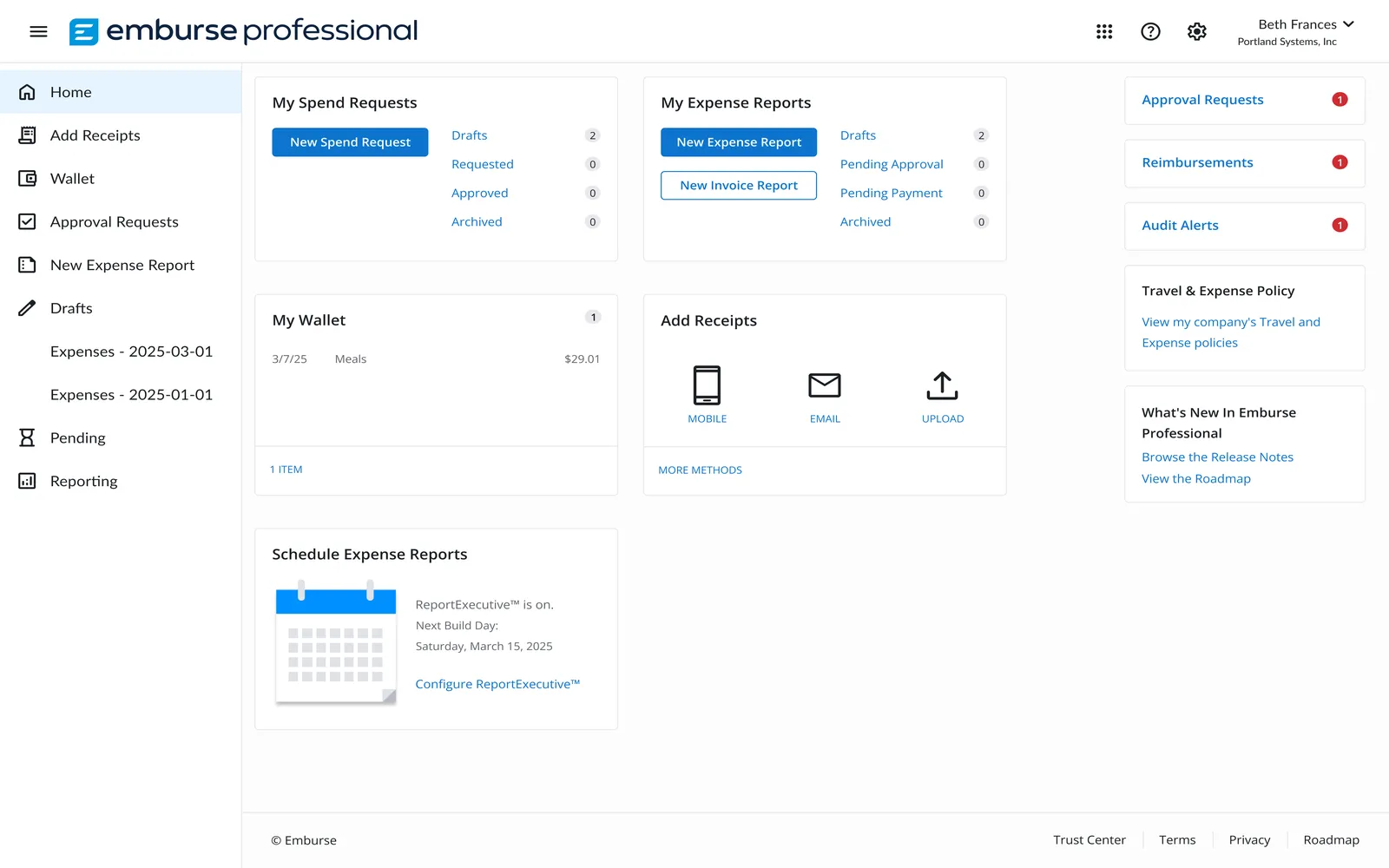

When searching for the best financial software for your business, consider the following key features:

- Real-time Financial Tracking: The ability to monitor your financial position in real-time is essential. This feature allows you to make quick decisions based on the latest data.

- Budgeting and Forecasting Tools: Look for software that offers robust budgeting and forecasting capabilities, enabling you to create accurate projections based on historical data.

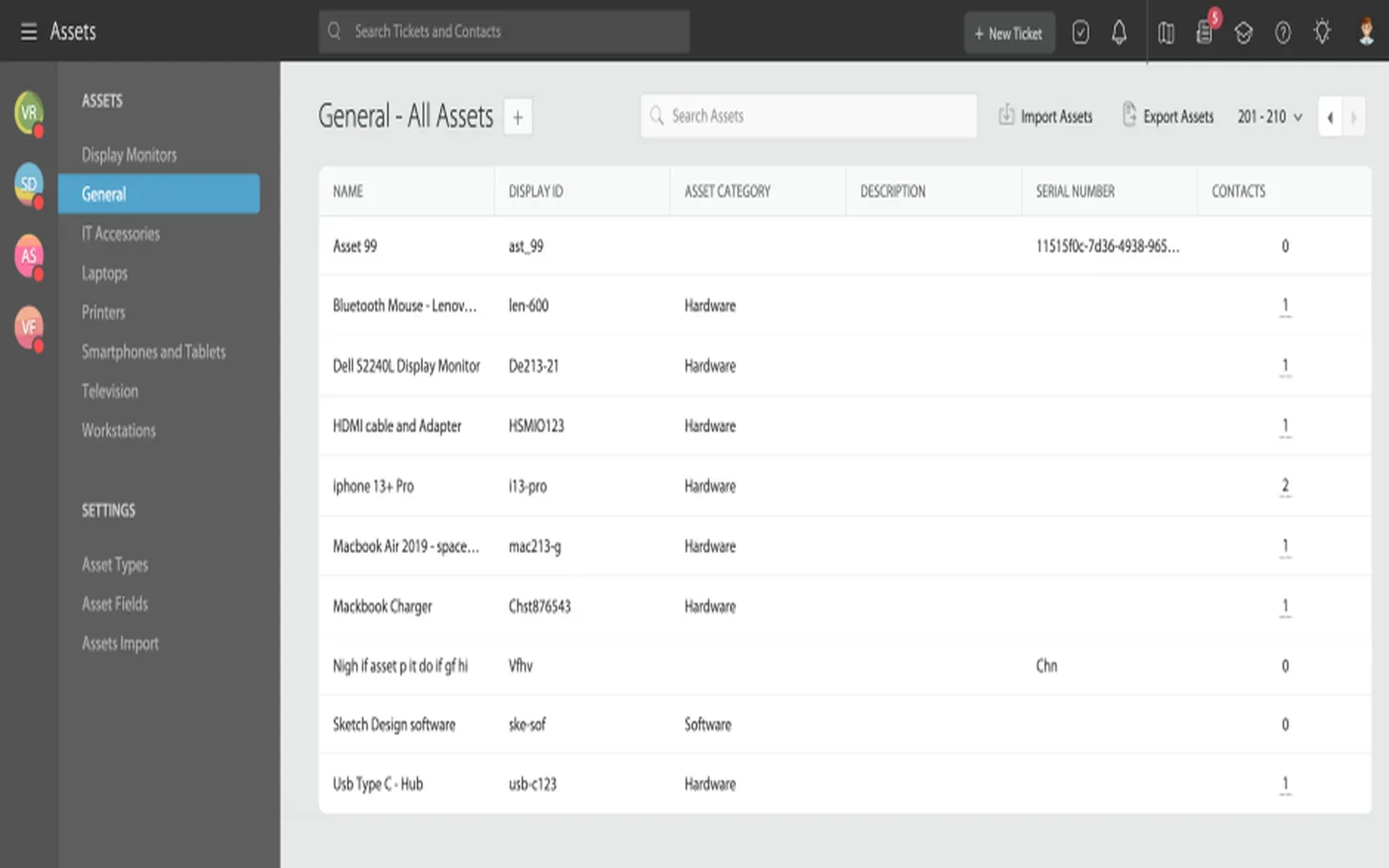

- Integration with Other Systems: Seamless integration with other business tools (like CRM and payroll systems) ensures that your financial data is consistent across all platforms.

- User-friendly Interface: A simple and intuitive interface can make it easier for your team to adopt the software and utilize its features effectively.

- Reporting and Analytics: Advanced reporting tools that provide insights into spending patterns and budget variances can help you identify areas for improvement.

Top Accounting Solutions for Business Budgeting

Here are some of the leading financial software solutions that can optimize your business budgeting:

| Software | Key Features | Pricing |

|---|---|---|

| QuickBooks | Real-time tracking, customizable reports, multi-currency support | Starts at $25/month |

| Xero | Budgeting tools, customizable dashboards, project tracking | Starts at $12/month |

| FreshBooks | Time tracking, invoicing, expense tracking | Starts at $15/month |

| Sage Business Cloud Accounting | Cash flow management, budgeting, and forecasting | Starts at $10/month |

| Zoho Books | Automated workflows, expense tracking, project management | Starts at $15/month |

Tips for Optimizing Your Budgeting Process

To get the most out of your chosen financial software, consider implementing the following best practices:

- Regularly Review Your Budget: Set aside time each month to review your budget against actual performance. This helps identify variances and allows for timely adjustments.

- Involve Your Team: Collaborate with different departments to gather insights on their financial needs and priorities. This can lead to a more comprehensive budget.

- Utilize Reporting Tools: Leverage the reporting capabilities of your financial software to generate regular reports that provide insights into your financial health.

- Set Clear Goals: Establish specific, measurable, achievable, relevant, and time-bound (SMART) goals for your budget. This will help guide your budgeting process.

- Stay Informed: Keep abreast of industry trends and economic changes that may impact your business. This knowledge will help you make better budgeting decisions.

Conclusion

Optimizing your business budgeting process is essential for maintaining financial health and achieving long-term success. By investing in the right financial software, you can streamline your budgeting efforts, gain valuable insights, and make data-driven decisions. Remember, the key to effective budgeting lies in the combination of advanced tools and sound financial practices. Start exploring the options available and choose the solution that best fits your business needs.